JLL Study: Coworking is More than Hype

JLL (NYSE: JLL), a leading professional services firm that specializes in real estate and investment management, recently published a paper that examined the phenomenon of flexible workspaces, focusing on Hamburg, Germany, and aimed to clarify whether co-working is more than hype.

The coworking trend first appeared in English-speaking countries a few years before reaching Germany. The paper identifies the 1995 Berlin-based programming community named C-base as the precursor of coworking in the country. The sector grew significantly over the following years due to the reduction in available space and rise in rental prices across most of the German real estate market.

The paper identifies three main models of coworking: coworking spaces in the narrow sense, hybrid model which describes a mix of private offices and open spaces, and business centers where fitted-out office spaces are rented out as private offices for short or longer terms, and provide other optional services and infrastructure. Advantages of coworking spaces include the focus on creating an interactive social environment. In practice, there is a trend for large, flexible workspace operators to move to a hybrid model. This combines elements of business centers (i.e. flexible leasing of small private offices) and elements of coworking spaces (i.e. open space, trend towards contemporary design, communal areas and collaboration).

There are several trends driving coworking. Technological advances enable people to work from anywhere. The rise of the start-up culture and digital nomads has also impacted the way we work. Digital start-ups in particular who benefit from low marginal cost and high scalability of their businesses benefit from the advantages of coworking spaces. Another important driver is the proliferation of the sharing economy, with coworking as one of its elements.

According to the recent study “Start-up-Unternehmen in Deutschland” (Start-up Companies in Germany) published by PwC, Hamburg is seen as a location expected to offer a highly attractive environment for new companies and significant potential demand for coworking space. In contrast to the current trend in respect of new company formations, office space take-up by startups as a core target group in the coworking segment has increased significantly here over the past few years, reaching its high point in 2014 with up to 40,000 sqm.

This study researched and classified flexible workspaces and analyzed further information relating to size and pricing models in Hamburg as at the end of August 2017. It considers the following types of operator: coworking space in its narrow sense (including selected office communities), business centers and hybrid model providers as described above. The latter category has been allocated to the business center or coworking segments depending on their positioning. According to the study, once all currently planned centers have opened, there will be around 9,800 workstations in flexible workspaces available in Hamburg.

The total number of workspaces (including planned locations) offered by flexible workspace operators equates to around 118,000 sqm of office space. This is less than 1% of the total office stock or a quarter of the average annual office space take-up, and around 3% in the city center. While coworking might currently account for a small percentage of offered office spaces, it has a high growth rate and attracts a lot of attention.

There is a great variation in prices for workstations in flexible workspaces. Asking prices in business centers range from €250 to just under €1,000/space p.m. In the coworking segment, asking prices range from €50/space p.m. to just under €400/ space p.m. The average (median) price in a hybrid centers is between €290/space p.m. for a coworking space in open-plan premises and €480/space p.m. for a private office. There are individual discounts for longer-term coworking memberships and in business centers. The wide range of prices is because the service is aimed at different target groups. Operators providing coworking space in its narrow sense often have lower costs and attract almost exclusively small companies. Operators of hybrid centers and business centers are aimed also at large companies.

Comparing the benefits of leasing self-contained office spaces vs. taking membership of a coworking space, a self-contained office lease contract generally means there are costs in setting up the contract in terms of legal advice, which are not required in the case of a membership of coworking space. In the case of a self-contained office, there are initial costs for equipment, tenant fit-out and more comprehensive office technology. This expense must be paid up-front or financed and is in some cases lost, as is the case with tenant fit-out at lease termination. Financing costs are not taken into account. There are also the refurbishment works. Furniture remains the property of the tenant upon lease expiry and is a more important consideration in the case of long-term letting decisions.

The total pre-contract costs for a self-contained office are significantly higher than for coworking space (around €60,000 compared to €14,000). But the monthly cost for the membership of the coworking space is around €1,300 higher. This is hardly surprising, as this is an inclusive fee and the coworking center operator’s costs must be remunerated through the monthly income. Looking at costs over a term of three years, both working models come to an almost identical cost of around €187,000. Over a period of just one year, the cost for a self-contained office is €102,000 and for a coworking space it is €72,000. Over a five-year period, the costs for a coworking space (€302,000) exceed the self-contained office (€271,000) by 11%.

The coworking trend continues to grow. The company rent24 is opening a combined coworking and coliving project in Eiffestrasse in 2018. WeWork has already rolled out the WeLive concept in the USA and is active in the leisure segment with WeWork Wellness. The study concludes with the expectation that the coworking boom is likely to continue, as people continue to pursue more flexible lifestyles and work conditions.

Join our Newsletter

Get our best content on Architecture, Creative Strategies and Business. Delivered each week for free.

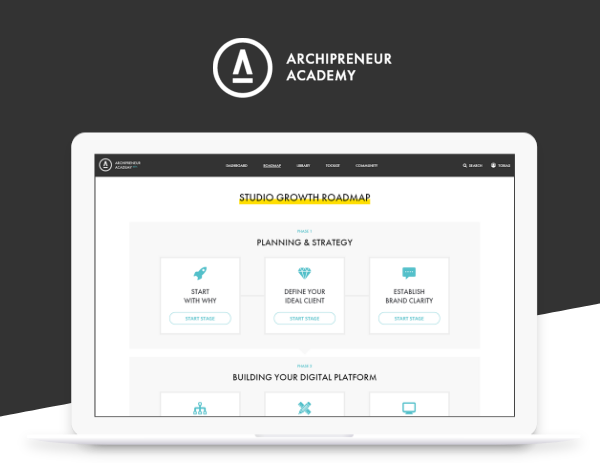

JOIN THE

ARCHIPRENEUR ACADEMY

- 9 Stage Studio Growth Roadmap

- Library of In-Depth Courses

- Checklists and Workbooks

- Quick Tips and Tutorials

- A Supportive Online Community